The Texas Tuition Promise Fund® allows a purchaser to lock in the cost of future undergraduate resident tuition and schoolwide required fees at Texas public colleges and universities at today’s prices. If a beneficiary attends a Texas private college or university, out-of-state college or university, medical or dental school, career school or registered apprenticeship program, where the tuition and required fees are not locked in, the purchaser can apply the Transfer Valuefootnote 1 towards the cost of tuition and schoolwide required fees. The plan offers flexible payment options that fit almost any budget. More information about the plan is available at TexasTuitionPromiseFund.com.

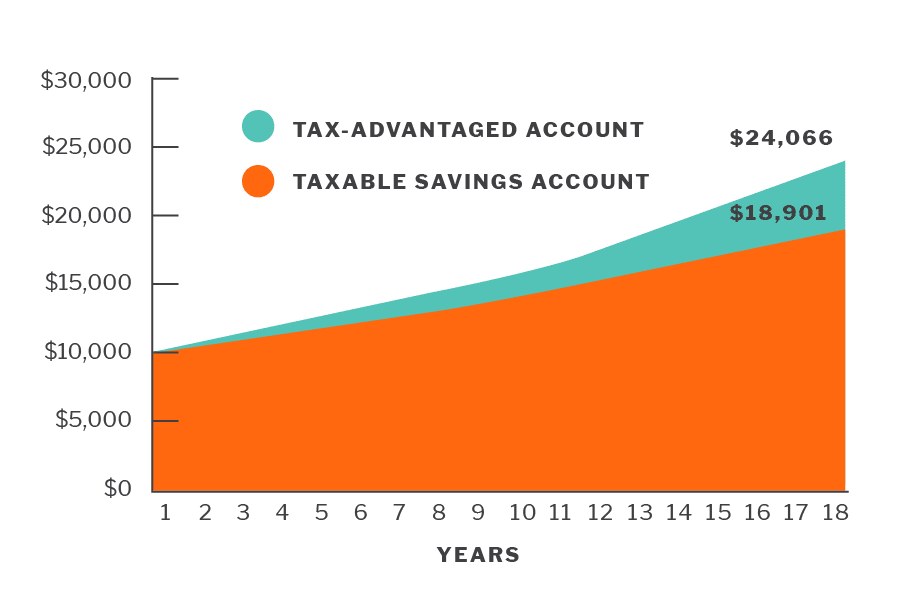

Earnings are tax free.

Any earnings on prepaid tuition contracts (the value of redeemed units over the amount paid for those units) are federal tax free if used to pay eligible tuition and schoolwide required fees.

Tuition is locked in — but your clients aren’t.

If the beneficiary doesn’t go to college or doesn’t need all the units, there are several options – such as rolling the Transfer Value footnote 2 to another 529 college savings plan, changing the beneficiary to an eligible member of the family of the existing beneficiary or requesting a refund.footnote 2

Texas residency requirement.

Any U.S. citizen or legal resident 18 years of age or older can open an account, as long as the beneficiary is a Texas resident. If the beneficiary is not a Texas resident, a parent must be the purchaser and a resident of Texas.

Open September through February.

General enrollment in the Texas Tuition Promise Fund is open annually from Sept. 1 through Feb. 28 (Feb. 29 in leap years). Newborn enrollment for children younger than 1 year of age extends through July 31.

Footnotes

- Transfer Value is limited to the lesser of: (1) the costs the tuition unit would cover at a Texas public college or university; or (2) the original purchase price of the tuition unit, plus or minus the plan’s net investment earnings or losses on that amount.

- See footnote 1.

-

For units held at least three years (and for contracts cancelled on the beneficiary’s death, disability, receipt of a scholarship, or admission to a U.S. Military Academy), the purchaser will receive the Refund Value, which is the price paid for the unit plus or minus the plan’s adjusted net investment earnings or losses on that amount. The earnings rate is set annually by the Board at a rate up to 2 percent less than actual net earnings, is capped at 5 percent, and is net of any fees. Earnings may only be paid on a refund subject to the actuarial soundness of the plan. The earnings portion of a refund may be subject to federal income tax, and state income tax for non-Texas residents, plus an additional 10 percent federal tax.

For units that do not meet the three-year holding period requirement, the purchaser will receive the Reduced Refund Value, which is the lesser of: (1) the price paid for the unit; or (2) the price paid for the unit plus or minus the plan’s net investment earnings or losses. As such, the Reduced Refund Value will not include any positive net earnings and can be less than the purchase price. No refund amount includes any state-provided or procured matching contributions or earnings thereon.